Tax & Business Attorney

Serving the Buffalo, Syracuse, Utica, Watertown, & Rochester, NY Areas

The Business and Tax Practice Group provides a broad range of services to its business clients in planning the structure and operation of the closely held business as well as working with the owners in developing estate and business succession plans that minimize the estate and income tax consequences of transferring their interests in the business.

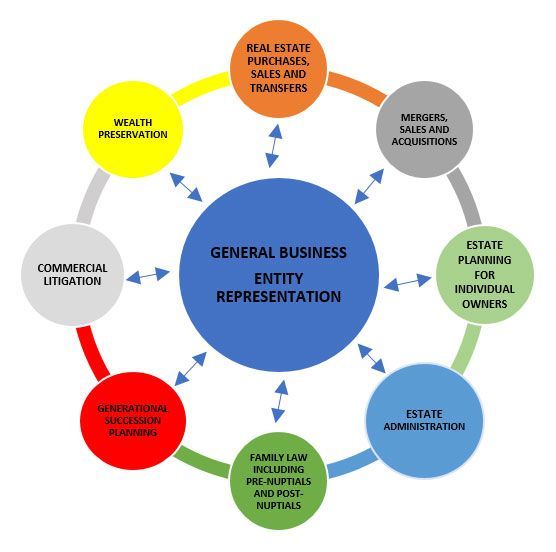

As general counsel for most of our business clients, we provide integrated legal representation in the many areas of practice that impact the day-to-day operations of the business as well as in those unexpected complex areas in which clients may find themselves from time to time.

Our Business and Tax Practice Group is composed of business attorneys in varied areas of the law who work closely together to provide our clients with the expertise and resources of a large firm but with the attention, efficiency, and responsiveness expected from a smaller, specialty firm.

Attorneys within the Business and Tax Practice Group are involved in all aspects of corporate governance, including acquisitions, mergers, and reorganizations of the business. We also counsel our clients with respect to contract negotiation, preparation, and dispute resolution for domestic as well as international transactions.

Today’s complex and continuously evolving tax laws require the individual, entrepreneur, and business owner to rely on the assistance of tax professionals who have the experience and knowledge required to effectively counsel them on particular matters. Whether it’s counseling our clients with the acquisition, reorganization or sale of a business, the structuring of an estate plan, or negotiating on their behalf before the State Department of Taxation or the Internal Revenue Service, the attorneys who are members of our Business and Tax Practice Group have earned their reputation for achieving results and peace of mind for their clients.

Our tax professionals are frequently invited to be lecturers before bar associations and state and local professional organizations on various complex tax topics such as estate tax planning, mergers, acquisitions, tax-free reorganizations, and business succession planning.

● Business development and formation

● Buying and selling of businesses

● Estate and tax planning and administration

● Federal and state income taxation

● Limited liability companies

● Mergers and acquisitions

● S corporations

● Succession planning

AREAS OF EXPERTISE

● Agri-Business planning

● Business development and formation

● Estate and gift taxation

● Estate and trust planning and administration

● Federal and state income taxation

● Generation-skipping tax

● Not-for-profit corporations and organizations

● Partnerships and joint ventures

● Sale and Acquisition of businesses

Our Business Attorneys Provide Versatile Counsel

The qualified team at Scolaro Fetter Grizanti & McGough, P.C. recognizes the evolving needs of business owners throughout the Syracuse, NY region. Keeping this in mind, we’re constantly expanding our representation options to suit the local demand. It doesn’t matter whether you own a large farm or a small boutique; you can rely on our proven business attorneys to provide versatile counsel at some of the area’s most competitive rates. We also are an experienced business contract attorney who ensures your agreements are clear, enforceable, and aligned with your best interests, helping to safeguard your business against potential disputes and legal complications.

Be sure to browse the following section to get a better sense of our current capabilities. As always, you’re welcome to contact one of our knowledgeable representatives with any additional questions, comments, or concerns. Our firm is proud to assist businesses and individuals throughout New York State, including the Buffalo, Rome, Rochester, Utica, and Watertown communities.

ATTORNEYS

For more information on our firm and its Business Practice Group, please contact any of the following attorneys: